Winding Up

A winding up or liquidation of a company represents the last stage in its life. It means proceedings by which a company is dissolved. The assets of the company are disposed of, the debts are paid off out of the realized assets, and the surplus, if any, is then distributed among the members in proportion to their holdings in the company. The two terms “winding up” and “liquidation” are used interchangeably.

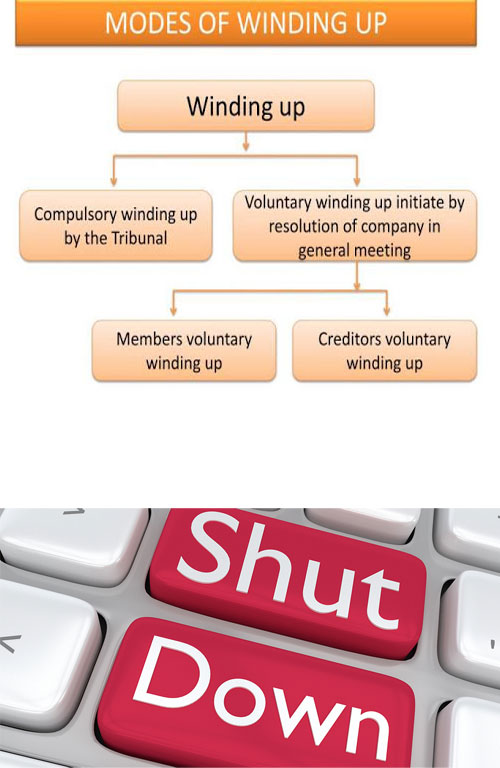

MODES OF WINDING UP-

Winding up of a Company by Tribunal Winding up of a company may be required due to a number of reasons including closure of business, loss, bankruptcy, passing away of promoters, etc., The procedure for winding up of a company can be initiated voluntarily by the shareholders or creditors or by a Tribunal. As per Companies Act 2013, a company can be wound up by a Tribunal, if: The company is unable to pay its debts. The company has by special resolution resolved that the company be wound up by the Tribunal. The company has acted against the interest of the sovereignty and integrity of India, the security of the State, friendly relations with foreign states, public order, decency or morality. The Tribunal has ordered the winding up of the company under Chapter XIX. If the company has not filed financial statements or annual returns for the preceding five consecutive financial years. If the Tribunal is of the opinion that it is just and equitable that be company should be wound up. If the affairs of the company have been conducted in a fraudulent manner or the company was formed for fraudulent and unlawful purposes or the persons concerned in the formation or management of its affairs have been guilty of fraud, misfeasance or misconduct in connection therewith and it is proper that the company be wound up. Voluntary Winding up of a Company The winding up of a company can also be done voluntarily by the members of the Company, if: If the company passes a special resolution for winding up of the Company. The company in general meeting passes a resolution requiring the company to be wound up voluntarily as a result of the expiry of the period of its duration, if any, fixed by its articles of association or on the occurrence of any event in respect of which the articles of association provide that the company should be dissolved. Steps for Voluntary Winding up of a Company The following are the steps for initiating a voluntary winding up of a Company:

Step 1: Convene a Board Meeting with two Director or by a majority of Directors. Pass a resolution with a declaration by the Directors that they have made an enquiry into the affairs of the Company and that, having done so, they have formed the opinion that the company has no debts or that it will be able to pay its debts in full from the proceeds of the assets sold in voluntary winding up of the company. Also, fix a date, place, time agenda for a General Meeting of the Company after five weeks of this Board Meeting.

Step 2: Issue notices in writing calling for the General Meeting of the Company proposing the resolutions, with suitable explanatory statement.

Step 3: In the General Meeting, pass the ordinary resolution for winding up of the company by ordinary majority or special resolution by 3/4 majority. The winding up of the company shall commence from the date of passing of this resolution.

Step 4: On the same day or the next day of passing of resolution of winding up of the Company, conduct a meeting of the Creditors. If two thirds in value of creditors of the company are of the opinion that it is in the interest of all parties to wind up the company, then the company can be wound up voluntarily. If the company cannot meet all its liabilities on winding up, then the Company must be wound up by a Tribunal.

Step 5: Within 10 days of passing of resolution for winding up of company, file a notice with the Registrar for appointment of liquidator.

Step 6: Within 14 days of passing of resolution for winding up of company, give a notice of the resolution in the Official Gazette and also advertise in a newspaper with circulation in the district where the registered office is present.

Step 7: Within 30 days of General Meeting for winding up of company, file certified copies of the ordinary or special resolution passed in the General Meeting for winding up of the company.

Step 8: Wind up affairs of the company and prepare the liquidators account of the winding up of the company and get the same audited.

Step 9: Call for final General Meeting of the Company.

Step 10: Pass a special resolution for disposal of the books and papers of the company when the affairs of the company are completely wound up and it is about to be dissolved.

Step 11: Within two weeks of final General Meeting of the Company, file a copy of the accounts and file and application to the Tribunal for passing an order for dissolution of the company.

Step 12: If the Tribunal is satisfied, the Tribunal shall pass an order dissolving the company within 60 days of receiving the application.

Step 13: The company liquidator would then file a copy of the order with the Registrar.

Step 14: The Registrar, on receiving the copy of the order passed by the Tribunal then publish a notice in the Official Gazette that the company is dissolved.

Winding up of a Company by Tribunal Winding up of a company may be required due to a number of reasons including closure of business, loss, bankruptcy, passing away of promoters, etc., The procedure for winding up of a company can be initiated voluntarily by the shareholders or creditors or by a Tribunal. As per Companies Act 2013, a company can be wound up by a Tribunal, if: The company is unable to pay its debts. The company has by special resolution resolved that the company be wound up by the Tribunal. The company has acted against the interest of the sovereignty and integrity of India, the security of the State, friendly relations with foreign states, public order, decency or morality. The Tribunal has ordered the winding up of the company under Chapter XIX. If the company has not filed financial statements or annual returns for the preceding five consecutive financial years. If the Tribunal is of the opinion that it is just and equitable that be company should be wound up. If the affairs of the company have been conducted in a fraudulent manner or the company was formed for fraudulent and unlawful purposes or the persons concerned in the formation or management of its affairs have been guilty of fraud, misfeasance or misconduct in connection therewith and it is proper that the company be wound up. Voluntary Winding up of a Company The winding up of a company can also be done voluntarily by the members of the Company, if: If the company passes a special resolution for winding up of the Company. The company in general meeting passes a resolution requiring the company to be wound up voluntarily as a result of the expiry of the period of its duration, if any, fixed by its articles of association or on the occurrence of any event in respect of which the articles of association provide that the company should be dissolved. Steps for Voluntary Winding up of a Company The following are the steps for initiating a voluntary winding up of a Company:

Step 1: Convene a Board Meeting with two Director or by a majority of Directors. Pass a resolution with a declaration by the Directors that they have made an enquiry into the affairs of the Company and that, having done so, they have formed the opinion that the company has no debts or that it will be able to pay its debts in full from the proceeds of the assets sold in voluntary winding up of the company. Also, fix a date, place, time agenda for a General Meeting of the Company after five weeks of this Board Meeting.

Step 2: Issue notices in writing calling for the General Meeting of the Company proposing the resolutions, with suitable explanatory statement.

Step 3: In the General Meeting, pass the ordinary resolution for winding up of the company by ordinary majority or special resolution by 3/4 majority. The winding up of the company shall commence from the date of passing of this resolution.

Step 4: On the same day or the next day of passing of resolution of winding up of the Company, conduct a meeting of the Creditors. If two thirds in value of creditors of the company are of the opinion that it is in the interest of all parties to wind up the company, then the company can be wound up voluntarily. If the company cannot meet all its liabilities on winding up, then the Company must be wound up by a Tribunal.

Step 5: Within 10 days of passing of resolution for winding up of company, file a notice with the Registrar for appointment of liquidator.

Step 6: Within 14 days of passing of resolution for winding up of company, give a notice of the resolution in the Official Gazette and also advertise in a newspaper with circulation in the district where the registered office is present.

Step 7: Within 30 days of General Meeting for winding up of company, file certified copies of the ordinary or special resolution passed in the General Meeting for winding up of the company.

Step 8: Wind up affairs of the company and prepare the liquidators account of the winding up of the company and get the same audited.

Step 9: Call for final General Meeting of the Company.

Step 10: Pass a special resolution for disposal of the books and papers of the company when the affairs of the company are completely wound up and it is about to be dissolved.

Step 11: Within two weeks of final General Meeting of the Company, file a copy of the accounts and file and application to the Tribunal for passing an order for dissolution of the company.

Step 12: If the Tribunal is satisfied, the Tribunal shall pass an order dissolving the company within 60 days of receiving the application.

Step 13: The company liquidator would then file a copy of the order with the Registrar.

Step 14: The Registrar, on receiving the copy of the order passed by the Tribunal then publish a notice in the Official Gazette that the company is dissolved.

Our Best Plans

Filing for Winding up of Company *

Filing for Winding up of Company *

Income Tax eFiling for 1 Year

MCA Annual Return Filing for 1 Year

Certificate of Commencement of Business

DIN KYC Filing for 2 Directors

Filing for Winding up of Company *

Income Tax eFiling for 1 Year

MCA Annual Return Filing for 1 Year

Certificate of Commencement of Business

DIN KYC Filing for 2 Directors

1 Year Overdue GST Return Filing

GST Cancellation

GSTR-10 Filing

...